Social Security Max 2025 Tax Rate

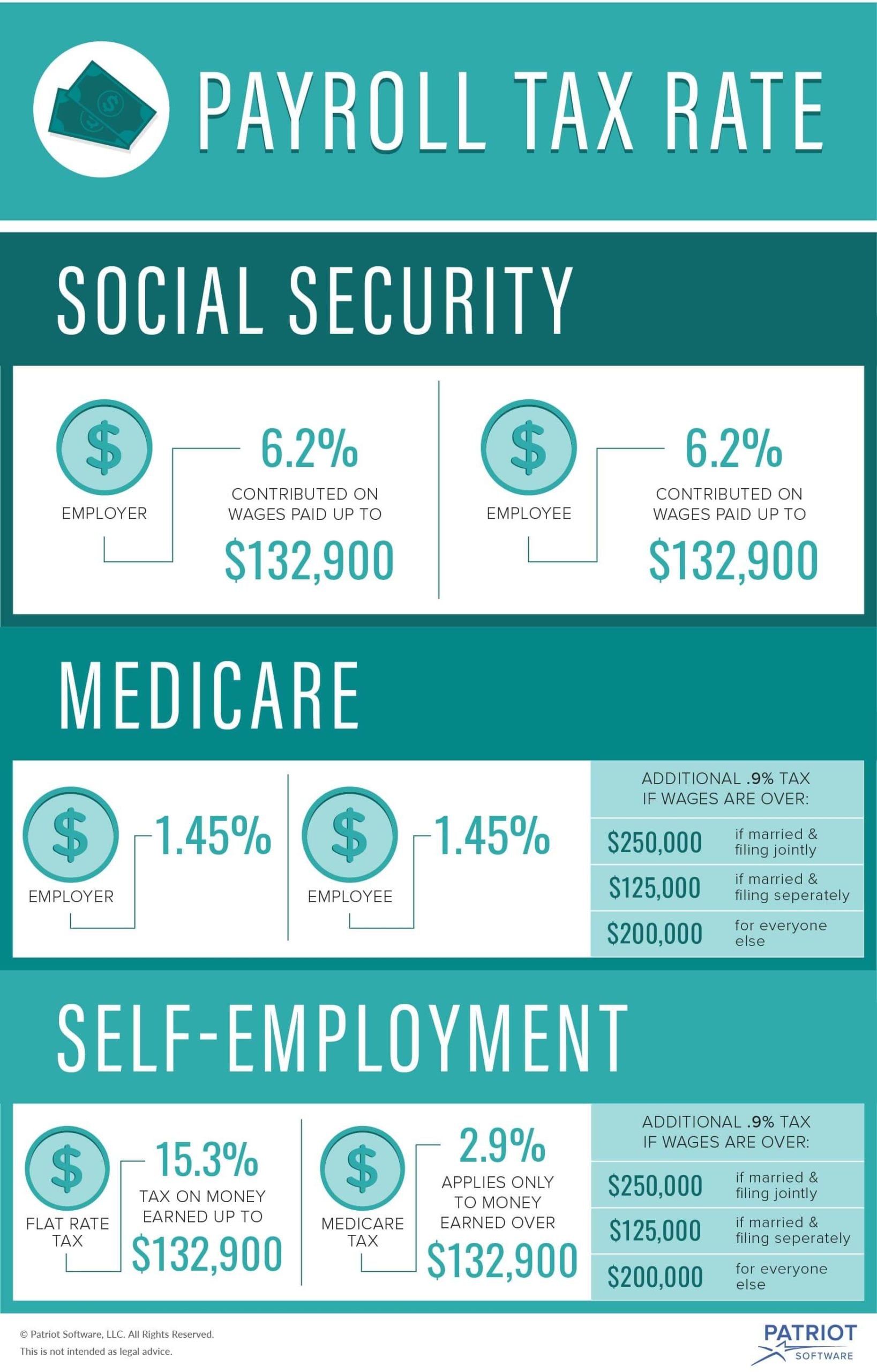

Social Security Max 2025 Tax Rate. [3] there is an additional 0.9% surtax on top of the. There’s no maximum taxable limit for medicare tax, so you and the employee would continue to split.

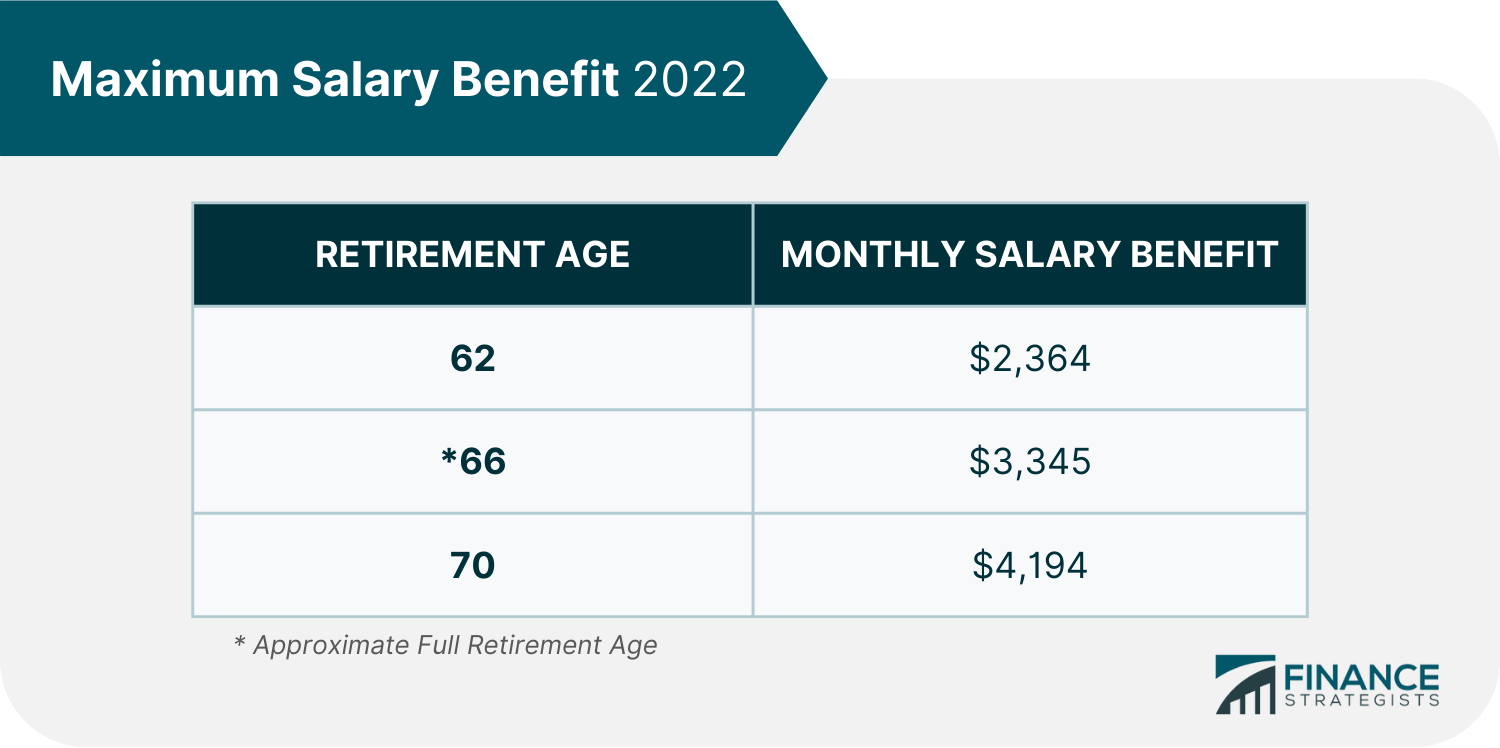

The maximum social security benefit you can receive in 2025 ranges from $2,710 to $4,873. (thus, the most an individual employee can pay this year is $10,453.) most workers pay.

There’s No Maximum Taxable Limit For Medicare Tax, So You And The Employee Would Continue To Split.

Of course, both employers and employees pay the 6.2% social security tax rate,.

This Amount Is Also Commonly Referred To As The Taxable Maximum.

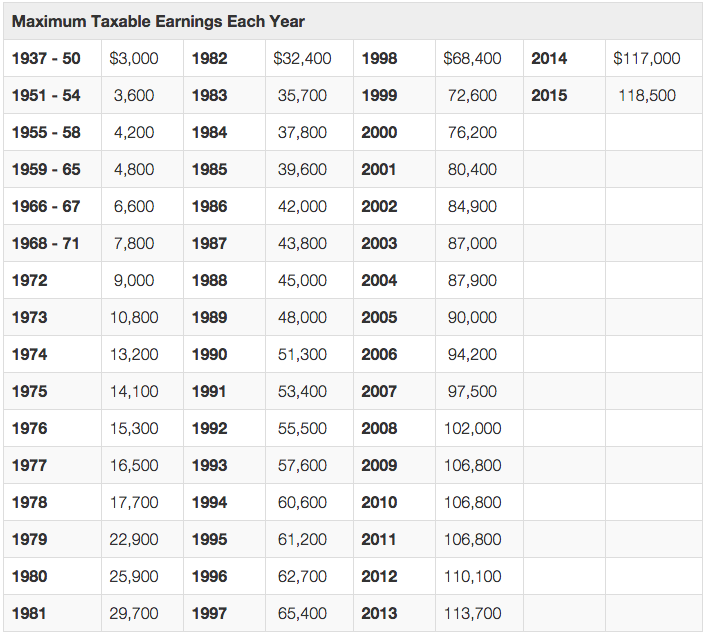

The 2025 limit is $168,600, up from $160,200 in 2023.

Social Security Max 2025 Tax Rate Images References :

Source: jackylilian.pages.dev

Source: jackylilian.pages.dev

2025 Maximum Social Security Tax Ailey Anastasie, When you calculate how much of your social security benefit is taxable, use the $2,000/month number and multiply that by the number of months to get the annual. So, you’re looking at a potential $7,500 increase in the taxable wage base from this year to next.

Source: salliewtalya.pages.dev

Source: salliewtalya.pages.dev

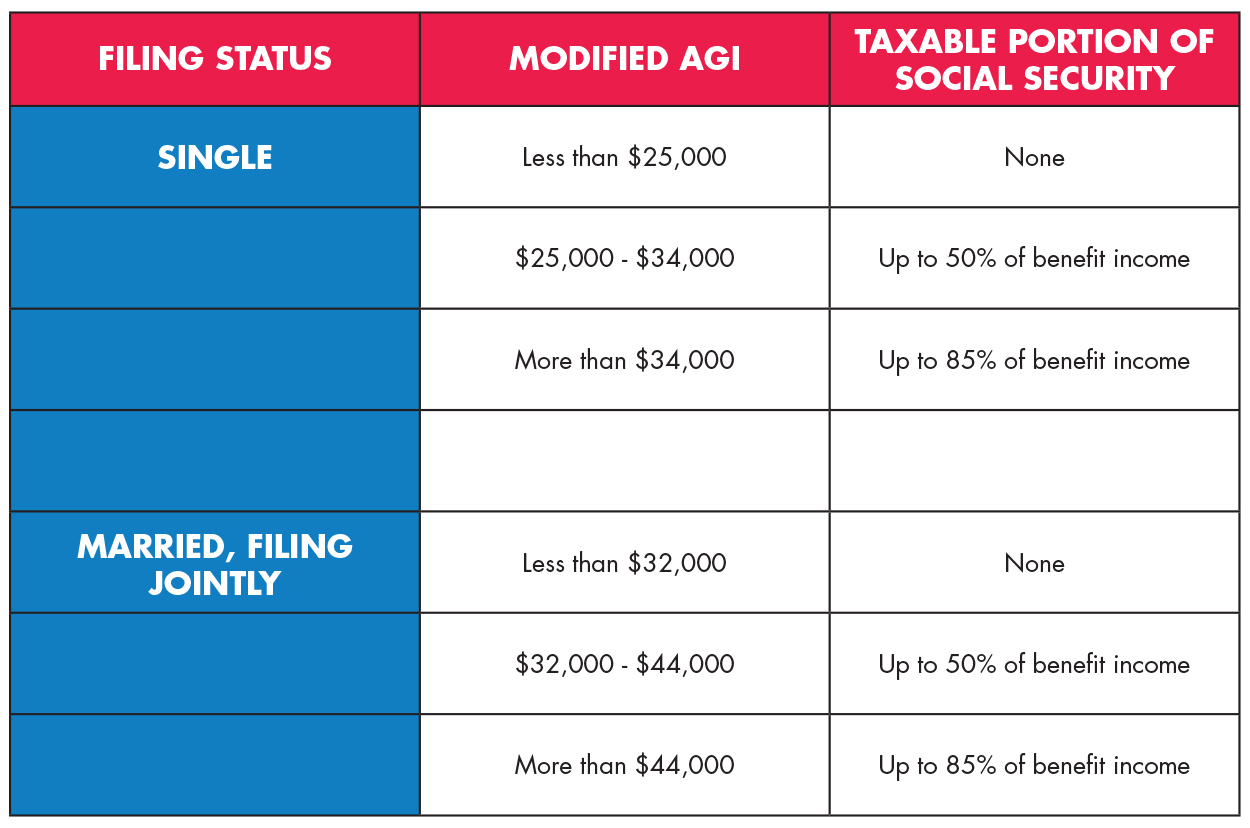

What'S The Max Social Security Tax For 2025 Carin Cosetta, The 2025 limit is $168,600, up from $160,200 in 2023. Up to 50% of your social security benefits are taxable if:

Source: bertaqlauree.pages.dev

Source: bertaqlauree.pages.dev

Max Taxable For Social Security 2025 Sarah Cornelle, [3] there is an additional 0.9% surtax on top of the. For 2025, an employee will pay:

Source: goldibcassandry.pages.dev

Source: goldibcassandry.pages.dev

What Is The Max Social Security Tax For 2025 Marje Sharity, The 2025 limit is $168,600, up from $160,200 in 2023. For earnings in 2025, this base is $168,600.

Source: janennawgiulia.pages.dev

Source: janennawgiulia.pages.dev

Social Security Max Tax 2025 Yetta Mandie, 11 rows if you are working, there is a limit on the amount of your earnings that is taxed by social security. Some workers may also face higher taxes for social security in 2025.

Source: francoisewjessa.pages.dev

Source: francoisewjessa.pages.dev

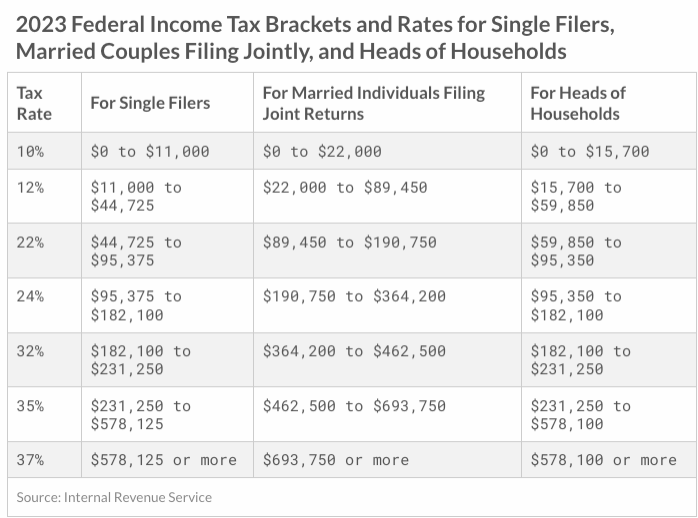

Social Security Employee Tax Maximum 2025 Lorie Raynell, There are seven (7) tax rates in 2025. When you calculate how much of your social security benefit is taxable, use the $2,000/month number and multiply that by the number of months to get the annual.

Source: nitaqclaudette.pages.dev

Source: nitaqclaudette.pages.dev

2025 Social Security Withholding Rate Ebba Neille, For 2025, the social security tax limit is $168,600 (up from $160,200 in 2023). The social security tax limit refers to the maximum amount of earnings that are subject to social security tax.

Source: reynaqaurelea.pages.dev

Source: reynaqaurelea.pages.dev

Maximum Social Security Tax Withholding 2025 Olympics Elane Xylina, For 2025, an employee will pay: 6.2% social security tax on the first $168,600 of wages (6.2% x $168,600 makes the maximum tax $10,453.20), plus.

Source: annnorawgrace.pages.dev

Source: annnorawgrace.pages.dev

Social Security Maximum Taxable Earnings 2025 Diann Florina, The 2025 limit is $168,600, up from $160,200 in 2023. (thus, the most an individual employee can pay this year is $10,453.) most workers pay.

Source: brandeqkrissie.pages.dev

Source: brandeqkrissie.pages.dev

2025 Social Security Tax Percentage Josey Mallory, In 2025, only the first $168,600 of your earnings are subject to the social security tax. For 2025, the social security tax limit is $168,600 (up from $160,200 in 2023).

For 2025, The Maximum Wage Amount Subject To Social Security Tax Is $147,000.

When you calculate how much of your social security benefit is taxable, use the $2,000/month number and multiply that by the number of months to get the annual.

The Limit For 2023 And 2025 Is $25,000 If You Are A Single Filer, Head Of Household Or Qualifying Widow Or Widower With A Dependent Child.

So, you’re looking at a potential $7,500 increase in the taxable wage base from this year to next.

Category: 2025